Through our steady pipeline of initiatives delivered through this Budget and building on our earlier investments, we will continue to support the healthcare system, households and businesses that underpin the Victorian economy.

Importantly, by implementing this plan over 10 years, we will ensure we don’t place a heavier burden on Victorian households and businesses through the post-pandemic recovery period. Deeper cuts and steeper tax increases might pay down COVID debt faster, but would come at the cost of weaker household and business balance sheets – and ultimately endanger the recovery.

The measures in this Budget are being implemented in a balanced and fair way.

Revenue measures are aligned to the relative size of businesses by payroll and land owned by commercial, industrial and other investors.

We won’t compromise Victoria’s economic growth and recovery from the pandemic. The important contributions that households and small businesses make to driving the state’s economy and jobs growth are critical – and will remain so as the economy navigates global challenges of high inflation and rising interest rates.

Rebalancing the size of the public service

The Victorian Government is doing what matters for Victorians, and delivering every election commitment we made in 2022. We will do this while ensuring our operations are as efficient as possible, including the size of the Victorian public service (VPS).

In the Victorian Budget 2021/22, we started the process of bringing the VPS back towards pre-pandemic levels, announcing $3.6 billion in savings and efficiencies as part of our fiscal plan to return to an operating surplus.

To build on that work, our savings program will reduce our VPS levels by 3,000 to 4,000 roles in 2023-24, across corporate and back-office functions. Further savings will be achieved through reductions in labour hire and consultancy expenditure. These savings are designed to make government more efficient, and will not affect frontline services.

Key benefits and opportunities

With this Budget, we’re delivering on every commitment we made to Victorians at the last election.

Building on the investments we’ve made over the past eight years, this Budget will keep investing in the things that matter to Victorians: a strong healthcare system, cleaner and cheaper renewable energy, high-quality road and rail, the best start in life for our kids – and an economy that works for working people.

We expect Victoria’s economy to grow steadily as we emerge from the current national and global economic challenges.

This will be bolstered by our strong pipeline of public construction projects, along with a recovery in population growth.

- Productive, long-term investment in infrastructure continues to be a priority, with government infrastructure investment projected to average $19.6 billion a year over the budget and forward estimates, which is significantly more than the 10-year average to 2014-15 of $4.9 billion.

- Population growth is forecast to be above its long-term trend rate from 2022-23 to 2024-25, and then settle at 1.7% over the remainder of the forward estimates.

Our prudent financial management will also ensure Victoria can navigate current challenges and global volatility, while still building on our advantages as a high-skill and high-value economy.

Future directions

Victoria’s capacity to pay down our COVID debt and further strengthen our finances is constrained. We raise only half the revenue we need for the services we deliver to Victorians, and as a result, the Commonwealth Government grants we receive are critical.

Victoria consistently receives less than our population share in areas including GST revenues and infrastructure – and that has been the case for many years. Further, under the National Health Reform Funding Agreement, costs were subject to a reduced Commonwealth contribution of 45% compared to 50%.

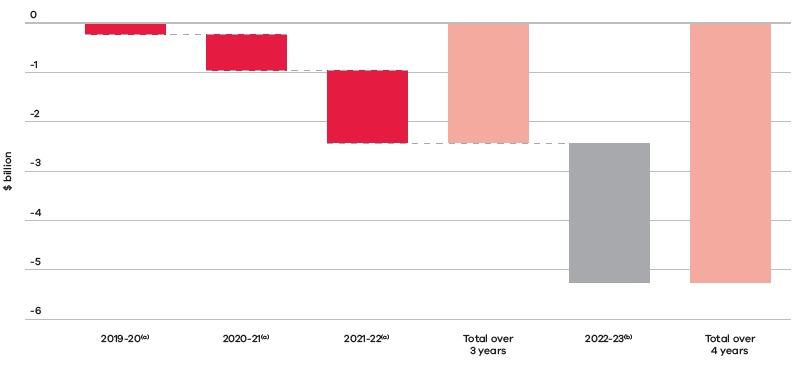

Since the pandemic began, Victoria has received almost $2.5 billion less in GST grant revenue from the Commonwealth Government compared to its population share between 2019-20 and 2021-22. Had we received this additional revenue from the Commonwealth, it would have provided Victoria with greater budget capacity and flexibility.

Victoria has had to borrow more to finance the same level of necessary expenditure over the period, since the pandemic began. This is despite the state having significantly higher real economic growth in 2021-22 – and contributing to higher levels of GST revenue collected by the Commonwealth Government.

As a result, the revenue measures included in the COVID Debt Repayment Plan have drawn heavily on Victoria’s limited taxation sources, while other spending measures continue to facilitate Victoria’s economic growth and recovery from the pandemic.

The Victorian Government will continue to seek Victoria’s fair share in Commonwealth Government funding towards future actions that progress the Government’s staged approach to its four-step fiscal plan in a careful and prudent manner.

Commonwealth Government GST grant revenue to Victoria foregone from lower than per capita share distributions

Source: Department of Treasury and Finance, Commonwealth Government Final Budget Outcomes (2019-20 to 2021-22) and 2023-24 Commonwealth Budget.

Notes:

Includes General Revenue Assistance payments from the Commonwealth which are sourced from the GST, including payments made under the no‑worse-off guarantee.

(a) Represents actual revenue received.

(b) Represents estimated Commonwealth transfers for 2022-23.

Missed opportunity for Commonwealth GST adjustments

The Commonwealth Government could have allowed a change to the method for distributing the GST during the pandemic to account for the significant economic disruption and financial impacts to our state.

While we support the Commonwealth Government’s aim of distributing GST revenues to help states with greater fiscal burdens, this was not the case through the pandemic for Victoria. The then Commonwealth Treasurer restrained the Commonwealth Grants Commission (CGC), the independent umpire, from being flexible and adjusting its calculations in this unprecedented period of economic and financial instability.

The CGC confirmed that its current method does not account for the pressures COVID-19 placed on states, particularly Victoria. The extra spending by Victoria on health and business support during the pandemic has resulted in around $880 million less GST funding to Victoria in 2023-24.

Furthermore, when Victoria provided $21.2 billion in business and economic support, the Commonwealth only provided a $3.1 billion contribution towards Victoria's business support programs. And then once JobKeeper concluded in 2021, the Commonwealth walked away from directly providing any further meaningful business and economic assistance to Victoria.

Reviewed 20 May 2023