COVID debt

Of the state’s total net debt, a significant subset was accumulated by incurring one-off expenditure and cutting taxes to directly respond to the pandemic. In other words, our direct COVID debt.

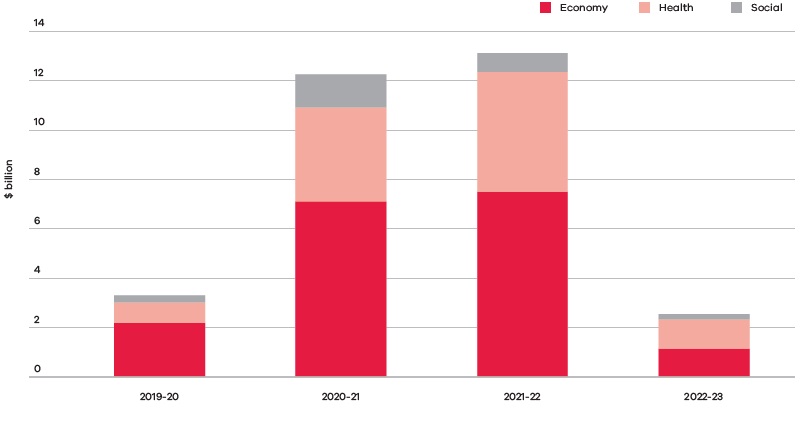

The value of this COVID debt is estimated to total around $31.5 billion in expenditure incurred and revenue foregone by the state, net of Commonwealth Government co-contributions, for activities primarily delivered between 2019-20 and 2022-23.

The Government has a bold infrastructure agenda, designed to support thousands of jobs across Victoria while delivering the everyday services Victorians rely on – especially as our state continues to grow.

Unlike our significant infrastructure program – which contributes to the long-term productive capacity of the state’s economy – our COVID debt relates to one-off investments designed to protect Victorians and Victorian businesses throughout the pandemic, and set the state up for recovery on the other side.

Our strong action to protect the health and livelihood of all Victorians helped shield our state from the very worst of this one in one hundred year event. As the state’s economic position is now sound, now is the time to pay off the debt and the accumulating interest incurred as a direct result of the pandemic.

COVID debt expenditure by category from 2019-20 to 2022-23 (a)(b)(c)

Source: Department of Treasury and Finance.

Notes:

(a) Forecast expenditure for 2022-23.

(b) Excludes budget funding of $238.3 million in 2023-24 for COVID-19 impacts on the transport network as published in Budget Paper 3, 2023‑24 Budget, Chapter 1.

(c) Excludes expenditure associated with Commonwealth Government co-contributions to represent expenditure incurred by the State contributing to COVID debt.

Different borrowings for different purposes

Victorians use different types of debt in their household budgets as well.

People often borrow to invest in assets like the family home, which then accumulates wealth as the value of the asset grows over time. In contrast, the credit card is used for emergencies that require significant and time critical action with less long-term wealth creation benefit.

Much like a home loan, we borrowed to fund a range of infrastructure projects that create significant long-term economic and social benefits such as major road and rail projects, and new and upgraded hospitals and schools. This is productive capacity infrastructure that creates jobs, helps our state function, and makes the economy bigger. This increases budget revenues which in turn provides the capacity to make interest payments and repay the debt over time.

Then the pandemic came along posing a global emergency, requiring significant spending on largely operational activities in a short time frame. We had to access emergency borrowings to save jobs and save lives.

There’s now a $31.5 billion balance from those emergency borrowings.

We have to get that balance back down to zero. Unlike our other productive capacity infrastructure investments, this debt does not accumulate wealth to the state in the form of long-term economic or social benefits.

Paying down COVID debt

Just like anyone with a mortgage, an increase in the cost of borrowing for the state is having real impacts on our financial capacity.

For example, the Victorian Budget 2020/21 forecast interest expense at $3.9 billion in 2023-24 on $173.4 billion of general government sector borrowings – while this Budget forecasts interest expense at $5.6 billion in 2023-24. This is an increase of 43% in interest expense, despite borrowings being lower.

We are not the only government in Australia that built up debt during the pandemic to support households and businesses. But we are the only government with a plan to manage it.

This Budget takes further steps towards stabilising net debt levels.

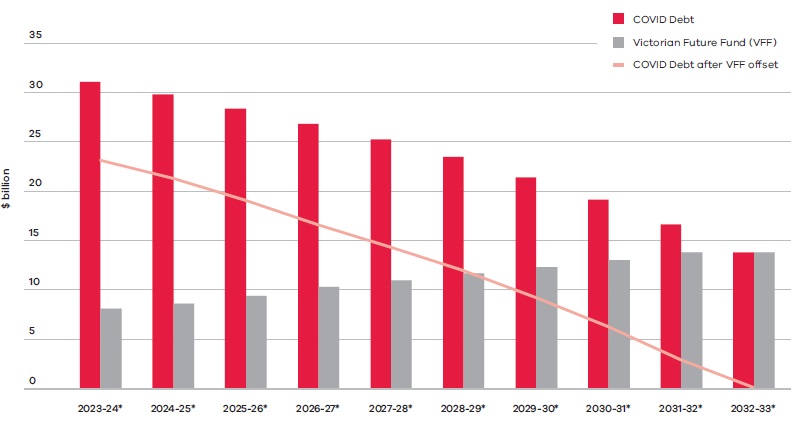

To help pay off the debt and accumulating interest incurred as a direct result of the pandemic, we’re introducing a new COVID Debt Repayment Plan. It builds on the work of the Victorian Future Fund (VFF), introduced in last year’s Budget, to help manage the COVID debt. The Plan is temporary, targeted and above all, responsible. It will raise an equivalent amount of funds, including covering interest, to pay down $31.5 billion of COVID debt over the next 10 years.

As part of the Plan, we’ll introduce a temporary levy to help pay off the debt incurred during this one-in-one-hundred-year event.

The COVID Debt Levy won’t apply to everyone. It will apply to big businesses, investors and those who pay land tax. And we’re making sure the repayment plan is structured in a way that’s reasonable and proportionate to ability to pay.

We know some did better out of the pandemic than others – and it is only fair that those that did better contribute the most to the repayment effort.

At the same time, the Government is doing its share, undertaking a range of balanced savings measures in this year’s Budget. We’ll rebalance our public service – bringing it back towards pre-pandemic levels – while maintaining the frontline services that matter to Victorians.

And importantly, we’ll also use the growing VFF balance to help manage the COVID debt as part of this plan.

COVID debt profile over 10 years following COVID Debt Repayment Plan (a)

Source: Department of Treasury and Finance.

Notes:

(a) COVID debt represents the closing balance including the impact of revenue raising measures, savings initiatives and interest expenditure associated with the debt in that financial year. Revenue and savings initiatives are those announced in Budget Paper 3, 2023-24 Budget, Chapter 1. The Victorian Future Fund refers to its balance, after accounting for additional contributions, income, capital gains and interest costs associated with contributions to the Fund.

* Financial years denote the position as of the end of June of that financial year.

Victorian Future Fund

In the Victorian Budget 2022/23, we established the Victorian Future Fund (VFF) to manage the fiscal impact of the pandemic and reduce the debt burden on future generations. This was our first step towards managing the state’s debt levels.

The VFF was established using proceeds from the VicRoads Modernisation Joint Venture. Further investments will be made in the future into the VFF through proceeds from designated government land sales. Investment returns from the VFF are quarantined and returned to the Fund so that its balance will grow over time to manage the borrowings.

The VFF is managed by the Victorian Funds Management Corporation (VFMC) which is implementing a diversified investment strategy designed to deliver the best possible returns.

Revenue and savings measures

The COVID Debt Repayment Plan includes a range of fair and balanced revenue and savings measures to help pay down COVID debt, including:

- A range of savings and efficiencies to be implemented across government, totalling $2.1 billion over four years. This includes reductions in corporate and back-office functions, reductions in labour hire and consultancy expenditure, and efficiencies across public non-financial corporations and public financial corporations. These savings are designed to make government more efficient, while maintaining the frontline services that matter to Victorians.

- From 1 July 2023, large businesses with national payrolls above $10 million a year will temporarily pay additional payroll tax. A rate of 0.5% will apply for businesses with national payrolls above $10 million, and businesses with national payrolls above $100 million will pay an additional 0.5%. The additional rates will be paid on the Victorian share of wages above the relevant threshold and are estimated to raise $3.9 billion to repay COVID Debt over four years.

- From 1 January 2024, the tax-free threshold for general land tax rates will temporarily decrease from $300,000 to $50,000. The family home will remain exempt from land tax. Those who pay land tax will attract a temporary additional fixed charge starting at $500 for landholdings between $50,000 and $100,000. There will be a $975 fixed charge for landholdings above $100,000 and the tax rates will temporarily increase by 0.1% for both general and trust taxpayers with holdings above $300,000 and $250,000 respectively. These changes are estimated to raise $4.7 billion to repay COVID debt over four years.

It is expected these tax changes will apply until 30 June 2033.

The measures we take now will mean we can keep investing in the health, education and infrastructure Victorians rely on – while also managing our finances responsibly.

Tax concessions that will continue

Payroll tax

A wide range of payroll tax exemptions will continue to apply for those that need it most, such as hospitals, charities, local councils, and wages paid for parental and volunteer leave. Further, businesses with payrolls under $10 million per annum will not be subject to the levy.

Land tax

The existing land tax exemptions will continue to apply. This includes exemptions on the primary place of residence, primary production land, land used by charities and residential care facilities.

Reviewed 22 May 2023